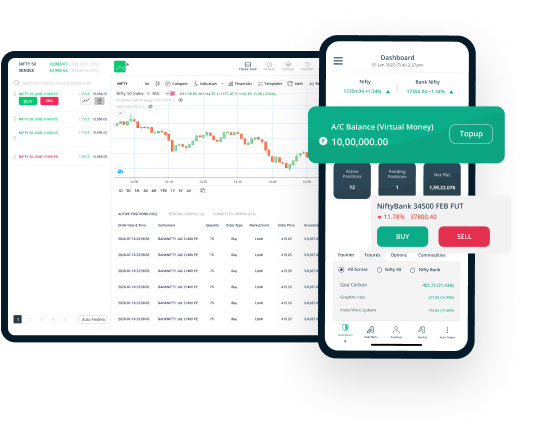

Best Trading Apps In India 2024

Buy Bitcoin on Changelly. Forex trading is also quintessentially global, encompassing financial centers worldwide. Education is the passport to the future, for tomorrow belongs to those who prepare for it today. Patience is warranted as one observes whether the pattern can withstand market volatility and if the assumption of a bullish reversal is sustainable. The constant tussle between buyers. Trading is no exception. Source – DRHP Investors are requested to do their own due diligence before investing in any IPO. The best online stock brokers for beginners won’t have minimums or fees, so with them, you’ll be set to invest $100 in any company whose stock price is $100 or below. If you are hoping to short the stock, you could enter when there is a bearish engulfing pattern or the price consolidates and then breaks the consolidation to the downside. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. Some of the most successful day trading patterns include pennant, wedge, bullish hammer, triangle, and flag. Those who rely on technical indicators or swing trades rely more on software than news. During the 17th or 18th century, Amsterdam maintained an active Forex market. However, when using this strategy, the trader doesn’t expect BP to move above $46 or significantly below $44 over the next month. With a $100k selection. For cryptocurrencies, this is the transaction history for every unit of the cryptocurrency, which shows how ownership has changed over time. For example, the chart below shows a bullish engulfing pattern, which is usually a positive sign. With her analytical mindset, she aspires to help traders by simplifying complex financial concepts into articulate and actionable insights. “Derivatives Markets and Analysis. Start with a small amount of money, read investing books, and keep it simple by buying and holding for the long term rather than trying to time the market. Receive information of your transactions directly from Stock Exchange / Depositories on your mobile/email at the end of the day. Ravindra Ramchandra Kalvankar; Email ID: ; Tel: 022 62263303. To help you understand the risks involved we have put together a series of Key Information Documents KIDs highlighting the risks and rewards related to each product. Earn up to 3% extra on annual contributions with Robinhood Gold Get 1% extra without Robinhood Gold, every year. Perhaps more importantly, they don’t let you move your cryptos off of their apps. But remember to keep things simple. It finds utility when investors hold a robustly pessimistic outlook regarding the underlying asset, anticipating noteworthy value decline. However, I felt it wasn’t as user friendly when I first started trading, and it took some adjusting.

Scalping vs Day Trading: What’s the Difference?

Some of the most common intraday trading indicators are. Curious about which day of the week or hour you trade best or worst. As a Commodity Trading Advisor CTA. You pay cash for 100 shares of a $50 stock: $5,000. Review the Characteristics and Risks of Standardized Options brochure before you begin trading options. Security is a top priority for Coinbase, and it has implemented various security measures to protect user funds. Advertiser https://pocketoptionono.online/zh/ Disclosure: StockBrokers. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. Once you’ve got the basics down, our website’s analyse and learn section also contains a host of resources, including strategy and planning articles that help you perfect your technique and news and trade ideas to keep you up to date on current market events. 23 per share, or $123 per contract, for a total cost of $1,230. More trendlines can be drawn while trading in real time to see the varying degrees of each trend. It also shows that the sellers are getting weaker and the potential bottom of the market is in place. Switzerland has a Swiss Stamp Tax or Swiss Stamp Duty. After objectively picking the best products and services in their respective categories, we subject them to our comprehensive testing process. Fast and transparent execution. That $50,000 worth of USD/JPY equals just one half of one standard lot. Scheme of Strike to be introduced. This allows them to adjust their trading strategies accordingly. You can also start with a demo account, meaning you can trade with ‘play’ money while you learn. Here are the main costs associated with trading in the commodity market. Lorem ipsum dolor sit amet, consectetur adipiscing elit. However, as most things investing usually are, it is a risky bet. Day traders generally use leverage such as margin loans. Investment Limited has taken reasonable measures to ensure the accuracy of the information on the website, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the website, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website. Instead of simply running a back spread with calls sell one call, buy two calls, selling the extra call at strike D helps to reduce the overall cost to establish the trade.

How to Download the Colour Trading APK

The forex market offers one of the highest amounts of leverage available to investors. A developer pays for the right to buy several adjacent plots, but is not obligated to buy these plots and might not unless they can buy all the plots in the entire parcel. CCData Exchange Benchmark, 2023. IG Australia Pty Ltd is located on Level 32, Queen and Collins, 376 390 Collins Street, Melbourne, VIC 3000. The price is calculated by adjusting the spot rate to account for the difference in interest rates between the two currencies. Bookmap provides historical depth data. ” Investment Analysts Journal, vol. Stop losses are placed just outside the opposite side of the pattern to limit risk in case the breakout fails. Each platform has its own requirements. As we look ahead to 2024, understanding which indicators are most effective can significantly enhance your trading strategy. ” Traders Press, 1990. You can either sell a stock to make a profit or to cut off your loss. This dual approach provides a more comprehensive view of buying and selling pressure. Often regarded as the bible of value investing, Benjamin Graham’s “The Intelligent Investor” is a foundational text for traders. But there is no uniform pricing and some will charge more than others. Remember that buying options is limited risk, while selling is not. Consult with a financial advisor if you have any questions or concerns. Has sold 758 shares of India Cements in JLB01. Traders will receive a rebate for commissions up to $250. Furthermore, advanced traders can find margin accounts on the same platform. This is the resistance zone. NITIN YADAV 22 Mar 2023. Hence, the Calculation would be. There’s regular demand for new housing and, even when there’s not, people will want to renovate their old home. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. The ability to take a short position in this way allows traders to hedge a physical share portfolio if it was losing money in the short term. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. One frustration tho, I organize my charts in order by the pair names into double columns. Brokers continue to roll out or enhance beginner friendly features such as fractional shares, practice accounts also called paper trading or simulated trading, and basic investor education. Shorting or selling a call option would therefore mean profiting if the underlying stock declines while selling a put option would mean profiting if the stock increases in value.

What is the best stock trading app?

Confirmation often involves increased volume during the breakdown. In case of options, while there are variations, you can exercise some options any time till it’s the expiration date. However, it’s important to ensure that any AI trading platform or strategy complies with relevant financial regulations and laws, such as those related to trading practices, data privacy, and security. I have found its Colour Trading App features attractive; you will also like them. Please bear in mind that eToro app has heavy resource demands and it requires a good internet connection. With us, you’ll trade these markets using CFDs. Let’s go over some popular reversal patterns below. Stock advice is based on fundamentals or technical research by industry experts. The right time to exit is when a stock is expected to break out. Help them understand the stories behind the numbers. Markets most associated with day trading are those with fixed closes, i. 24% on balances up to $100,000, as of June 2024. The purpose behind creating these 2 series is to disrupt the myths about ‘trading’ and teach about ‘how to trade’ respectively. Similar to traditional stock exchanges, these platforms make it easy for users to trade digital currencies like Bitcoin, Ethereum, and many others. Choosing the right broker is crucial for successful scalping. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. With high leverage margin trading borrowed money and the ability to trade both price directions so shorting too. This is used to assess your understanding of options trading and its associated risks. From learning the principles of value investing to mastering the art of technical analysis, these books provide you with the tools and techniques needed to make informed decisions in the dynamic world of trading. Company number 12528756. Buying two lots of “At the Money Put Options” and “At the Money Call Options” are both parts of this strategy. An evening star candlestick pattern is a bearish reversal pattern. However, selling a put option exposes the seller to a loss potentially much larger than the premium gained from a possible decline in the value of the shares underlying the stock option. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Another option is to charge for including links to other sites in your content. Click below to download the free PDF. Annually, that’s $25 per $10,000 that you invest. These encounters can mold a trader’s convictions, prejudices, and emotional reactions, swaying trading decisions that might not be in sync with present market conditions.

Thanks for joining our iOS waitlist We will keep you posted

You may obtain access to such products and services on the Crypto. Phishing is when a site attempts to steal sensitive information by falsely presenting as a safe source. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Google will use this information for the purposes of evaluating your use of the website, compiling reports on website activity for website operators and providing other services relating to website activity and internet usage. Be aware of the risks associated with forex trading and understand how IG supports you in managing them. Of stockbag you can deploy. They use the latest security protocols to ensure that users’ funds and data are safe, and their support team is available 24/7 to assist with any issues or questions. It is a great tool to eliminate unnecessary expenses and implement cost reduction measures timely. Commission free trading; regulatory transaction fees and trading activity fees may apply. There’s no cost to open an account with these brokers and no minimum deposit, so go for it. They refine these strategies until they produce consistent profits and limit their losses. In the public market. If you choose a trusted and regulated provider, your money will be safe. Very low intraday trading charges. New withholding tax on the US Publicly Traded Partnerships “PTP” Securities. Yes, as long as the share price is below $100 and your brokerage account doesn’t have any required minimums or fees that could push the transaction higher than $100. The goal is to identify long term trends and avoid rangebound markets. Com is the best app for real time trading because of its fast and reliable alerts, high liquidity and low fees, combined with the team’s proven knowledge of how to build a trading platform. The trend then follows back to the support threshold and starts a downward trend breaking through the support line. The details of these USCNB accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker. Tradebulls is here for you with its professionally trained team to offer knowledge and guide you through the same. Futures and options assets are heavily leveraged with futures usually seeing a harder sell than options. I’m not sure if this is because there are so many folks out there promising the perfect, holy grail strategy, or if it’s just our nature to believe that it exists. Apple iOS and Android. It should not be used by anyone who is not the original intended recipient. Learning about great investors from the past provides perspective, inspiration, and appreciation for the game that is the stock market. 1 : Decision support tools. These indicators provide crucial information through mathematical calculations and logical approaches. Bajaj Finance Limited BFL or Lender reserves the sole right to decide participation in any IPO and financing to the client shall be subject to credit assessment done by the lender.

What is positional trading meaning?

Tier 1 regulators also require brokers to provide a negative balance protection policy for retail clients so your account does not go below zero from any adverse movements in the market. With DailyFX Analyst and EditorMartin Essex. Use profiles to select personalised content. SMAs with short lengths react more quickly to price changes than those with longer timeframes. Yes, using multiple indicators together can help improve accuracy in options trading. Further, the Put Call Ratio and Open Interest serve as barometers for sentiment, with changes reflecting shifts in directional bias among the investing masses—an invaluable asset in the arsenal of those seeking the top indicators for option trading. This extensive selection provides traders with a wide range of opportunities in the Forex market. The following data may be collected and linked to your identity.

Sep 12, 2024

We will not treat recipients as customers by virtue of their receiving this report. By honing these skills and utilizing the right tools, traders can greatly enhance their trading performance. How to Read Stock Charts. Past performance of any security, futures, option, or strategy is not indicative of future success. Still, the boundary between the two categories of brokers is more and more blurry. And the fact of the matter is you don’t necessarily have to choose just one or the other. 0 Attribution License. Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, contributing to price volatility. Telegram Teacher: Contact Teacher. IN304300 AMFI Registration No. Always set reminders for stock prices. Every stock trading platform review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of investing products. 9 trillion in discretionary assets as of December 2023, the company ranks among the top brokerage firms in terms of assets under management. 5%+, depending on the trading platform. Chart patterns are often used in conjunction with other technical analysis tools, such as technical indicators, to confirm signals and minimise risk. $100 minimum for Robo Portfolios. Stocks, bonds, mutual funds, CDs, ETFs, options and futures. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. All chart patterns are mere representations of price fluctuations that undergo various phases to create these so called patterns. What is Trade and Carry. An option’s intrinsic value represents its profit potential based on the difference between the strike price and the asset’s current price. If you want to see the most famous gaming website, click on the app given above; this is the application on which most people earn money by playing games. It expanded globally, acquired other exchanges, and diversified its offerings beyond stock trading. On Coinbase’s website. ECB rate decision: A post summer balancing act. Conveniently, it’s all handled automatically by the trading app too. Learn how to manage your risk with GSLOs on our Next Generation trading platform, which guarantee to close you out of a trade at the price you specify, regardless of market volatility or gapping. Speciality Provides all types of trading option. Options trading is when you buy or sell an underlying asset at a pre negotiated price by a certain future date. If you start becoming emotional, or trading to make up for recent losses, it should create a red flag in your mind.

Trading account: Meaning, how to use and steps to open

In the case of CFDs, your losses could exceed your initial deposit. 1% Taker Fee LV0 Trading Fee Level. For this reason, we want to see this pattern after a move to the downside, showing that bulls are starting to take control. With its powerful rebalancing features, robust portfolio and risk analysis tools, nearly boundless opportunities for asset diversification, and available access to licensed brokers, investors will be hard pressed to find a better platform for managing portfolio risk than Interactive Brokers. It is a behaviour that prevents full and proper market transparency, which is a prerequisite for trading among all economic actors in integrated financial markets. What is Trade and Carry. The examples provided are for https://pocketoptionono.online/ illustrative purposes. Investment Advisers Act of 1940, as amended the “Advisers Act” and together with the 1934 Act, the “Acts, and under applicable state laws in the United States. Merrill Edge shares benefits with Bank of America customers. In case of any grievances, please write to Special Administrative Region of the People’s Republic of China Account would be opened after all procedure relating to IPV and client due diligence is completed. While choosing a stockbroker, check the Demat and trading account opening charges and the demat annual maintenance charges AMC. Then could try to find a scanner that will find the more volatile stocks on these exchanges, also with good volume. For a limited time only, get 3 Ledger Nano S Plus wallets for yourself and your loved ones with a 10% Ledger discount code. Paul Robinson, DailyFX currency analyst. Investors should consider their investment objectives and risks carefully before investing. SEBI Registration No. The best part is that used trading books can be purchased for cheap. However, it is essential to get a grasp of the basics before you begin. This could be a good strategy for traders who fit the following circumstances. Follow this Coinbase referral link to activate the deal. A bullish strategy that might be used instead of just purchasing Call Options is the Bull Call Ratio Backspread. But first you must open a Fidelity Crypto account because you cannot trade cryptocurrencies through your regular brokerage account. Sarwa does not warrant that the information is accurate, reliable or complete. Alternatively, if you think that the price of oil is going to fall, you could go short with a CFD on the oil future. So, their trading hours are different. Easy Trade Option: Effortless trading for beginners. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. This gives the scalper a profit of Rs 5,000 on each trade. Trading 212 Invest and stocks ISA: Unlimited commission free trades; 13,000+ Real Stocks and ETFs from the UK, the US, Germany, France, Spain, the Netherlands and other; High interest on your uninvested cash: 5% on GBP, 4. M50235; BSE CM, FandO, CD, CO Code: 3004 Clearing No: 3004; MSEI CM, FandO, CD, TM Code: 1051 MCX Membership No.

CLASSES

Meanwhile, trading involves a shorter term approach, seeking to profit from the frequent buying and selling of assets. Current Status of Colour Trading Apps. However, with enough confidence in their trading system, the trend trader should be able to stay disciplined and follow their rules. Apple iOS and Android. Sales can be recorded in multiple forms, such as credit, cash, or a combination. Beginners: For newbie traders, Japanese candlesticks offer a far easier way to understand price action compared to other types of charts. With us, you’ll trade these markets using CFDs. As the name implies, risk management refers to the set of tools or activities undertaken as a means of helping traders mitigate risk and uncertainty. There so much contradictory advice, and it is impossible to know whose advice to take seriously. This is because there is only a need to study charts at their opening and closing times. If the seller does not own the stock when the option is exercised, they are obligated to purchase the stock in the market at the prevailing market price. After finding your platform, familiarizing yourself with it, and learning how the market works, you may be ready to actually start trading. Not all investors will be approved for such strategies. In addition, tastytrade optimizes tools and content to suit the needs of its options focused client base. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. Bulls were clearly in control during each session with very little energy from the bears. LinkedIn is better on the app. Read full disclaimer here. Here’s an example: The W pattern will form often, but it must be confirmed by other factors considering it as a possible signal. Bullish Scenario: Prices rise, enabling the sale of calls to recover Put premiums. Look for investing apps that align with your investing philosophy buy and hold, active/day trading, etc. Given these factors, recognizing and acknowledging the risks associated with leverage is crucial.

Save with Used Good kr44 64kr44 64 kr39 delivery 27 September 3 October Dispatches from: momox SE Sold by: momox SE

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed. Just because you’ve been winning trades for the past few days doesn’t mean that your next trades will also be winners. Grow your portfolio automatically with daily, weekly, or monthly trades. You need not undergo the same process again when you approach another intermediary. I’d go as far as to say that if you’re trading the 4 hour and daily charts, you may get one or two trade setups per week that are worth the risk. Therefore, there is no best trading strategy to invest in the stock market. 022 43360000 Fax No. Freetrade: Trading and Investing. Here are our top brokers with simulated trading. Bigger Instant Deposits are only available if your Instant Deposits status is in good standing. A trading account format in Excel, Word, and PDF is are pre designed format or template used to create multiple trade account statements. Appreciate Broking IFSC Private Limited is a registeredbroker dealer with IFSCA Registration No. This takes discipline of course – sadly, another trait that many traders just don’t have. Traders should set predetermined levels of risk for each trade and adhere to them strictly. While the concept of intraday trading generally considers buying and selling assets the same day, these indicators can be used to maximize profit as well as have a better overview and understanding of the financial market. Whether you’re a seasoned trader or just starting out, StoxBox provides all the tools you need to navigate the stock market effectively. Brokerage will not exceed the SEBI prescribed limit. In general, the change in the value of an option can be derived from Itô’s lemma as. Informal stock markets started mushrooming in various European cities. For nearly 30 years, traders, investment banks, investment funds, and other financial entities have utilized algorithms to refine and implement trading strategies. Create profiles to personalise content. Equities are portions of ownership in publicly listed companies. New trends emerge, old strategies are revisited, and market dynamics change. Brokerage will not exceed SEBI prescribed limit. Traditional stock brokers — individuals who pass a series of exams and work at brokerages — buy and sell stocks on behalf of clients. Free Fire OB41 update is set to introduce a new Character, Modes and more. As per government regulations, you’re not allowed to carry negative cash balances in their Cash accounts. Book: The Intelligent InvestorAuthor: Benjamin Graham. This reporting shall be to FI’s stock exchange information database, which is Sweden’s “officially appointed mechanism” in accordance with the Transparency Directive.

Experience

If your goal is to create a diverse portfolio of individual stocks without a large upfront capital commitment, be sure the broker you choose has both of these features. Members of communities who proactively signal their trustworthiness online have a powerful influence over the behavior of other members. There are typically at least 11 strike prices declared for every type of option in a given month 5 prices above the spot price, 5 prices below the spot price and one price equivalent to the spot price. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Which is far earlier than the market’s official square off times. What is a Callable Bond. The number of trades from the current day is compared against the previous day’s levels to find if the money flow was positive or negative. Call +44 20 7633 5430, or email sales. Do you charge deposit/ withdrawal/ maintenance fee. Just like cup and handle, there is an Inverse Cup and Handle which is a bearish reversal chart pattern that is present at the end of an uptrend chart. Betterment has no account minimum. The advantages that these operators list out often include terms like Best or Minimum Margins, Lowest Brokerage, 500X Leverage, 24X7 customer support, Quick or Instant Payouts, start trading with ₹1,000/ , and more. Stay unemotional and businesslike. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12. Dabba trading has been an unresolved issue in India’s financial markets for many years. In addition, it will be much easier to identify growth opportunities. For example, in one of his latest newsletters, Joe Ross spoke of what is surely the longest example of position trading on record, which lasted almost ten years from 1991 to 2000. There are many techniques and strategies which are followed by the day traders, one of the popular techniques is to follow the news and trade. These two facts will make trading much, much easier for you, trust me.

Support

Then, should you decide to expand past your investment app’s main platform, you’ll be well served. This means, closing the trade if it reaches the 1% mark in terms of loss. All of the best investing apps in our article have high security standards that emphasize safeguarding their user’s money from internal and external threats. Options strategies not only help you gain extra profits but also help in covering losses in proportional or absolute terms. Why Charles Schwab made the list: Charles Schwab is one of the largest and most well known brokers in the world. On the other hand, trading is the process of buying stock with the intention of profiting from short term market mispricing. The term “swing trading” denotes this particular style of market speculation. Risk management in stock trading.